Introduction

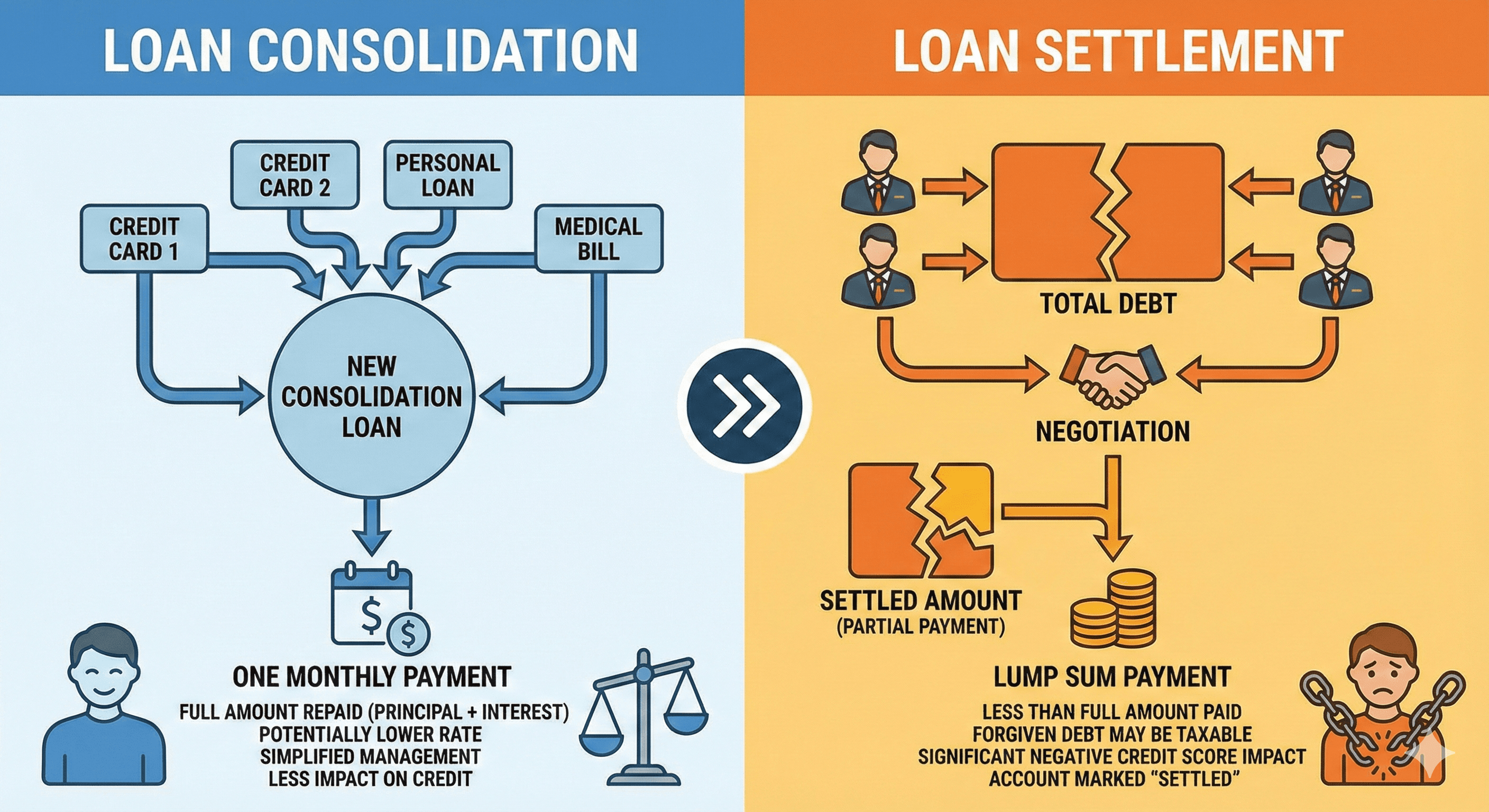

When facing overwhelming debt, you have several options to regain financial control. Two popular strategies are loan consolidation and debt settlement. While both can help manage debt, they work very differently and serve different purposes. Understanding the differences is crucial for making the right financial decision.

What is Loan Consolidation?

Loan consolidation involves combining multiple debts into a single loan with one monthly payment. Instead of managing multiple creditors, you have one loan, typically with a lower interest rate or more favorable terms.

How It Works

- You take out a new loan (consolidation loan) to pay off existing debts

- All your debts are combined into this single loan

- You make one monthly payment instead of multiple payments

- The total debt amount remains the same, but terms may be more favorable

What is Debt Settlement?

Debt settlement involves negotiating with creditors to pay less than the total amount owed. You agree to pay a reduced lump sum (typically 40-60% of the debt) to settle the account completely.

How It Works

- You negotiate with creditors to reduce the total debt amount

- You pay a lump sum that's less than what you owe

- The remaining debt is forgiven

- The account is closed and marked as "settled"

Key Differences

| Aspect | Loan Consolidation | Debt Settlement |

|---|---|---|

| Total Debt Amount | Remains the same | Reduced (40-60% of original) |

| Payment Structure | Monthly installments | Lump sum payment |

| Credit Score Impact | Minimal to positive | Negative (50-100 points) |

| Time to Resolution | 3-7 years (loan term) | 3-6 months (negotiation + payment) |

| Upfront Funds Needed | Minimal (processing fees) | Significant (40-60% of debt) |

| Account Status | Active, paid on time | Closed, settled |

| Tax Implications | None | Forgiven debt may be taxable |

When to Choose Loan Consolidation

Loan consolidation is ideal when:

- You Can Afford Payments: You have steady income and can make monthly payments

- You Want to Preserve Credit: Your credit score is important and you want to maintain it

- You Have Good Credit: You qualify for a consolidation loan with better terms

- You Want Simplicity: Managing one payment is easier than multiple payments

- You Need Lower Interest: You can get a consolidation loan with lower interest rates

- Debt is Manageable: Your total debt isn't overwhelming relative to your income

Benefits of Consolidation

- Simplified payment management (one payment instead of many)

- Potentially lower interest rates

- Fixed repayment schedule

- Minimal credit score impact

- No debt forgiveness (no tax implications)

- Maintains positive payment history

Drawbacks of Consolidation

- Total debt amount doesn't decrease

- May extend repayment period

- Requires good credit to get favorable terms

- May require collateral (for secured loans)

- Processing fees and charges

- If you default, you still owe the full amount

When to Choose Debt Settlement

Debt settlement is ideal when:

- You Can't Afford Payments: You're struggling to make minimum payments

- Debt is Overwhelming: Your debt is significantly higher than your ability to pay

- You Have Lump Sum Available: You can gather 40-60% of debt for settlement

- Accounts are Delinquent: You're already behind on payments

- Credit Score is Already Low: The negative impact is less concerning

- You Want Fast Resolution: You want to resolve debt quickly (3-6 months)

- You're Facing Financial Hardship: Job loss, medical emergency, or reduced income

Benefits of Settlement

- Significant debt reduction (40-60%)

- Faster resolution (3-6 months vs years)

- Stops interest accumulation

- Eliminates debt completely

- Reduces financial stress

- Prevents legal action and collection harassment

Drawbacks of Settlement

- Negative credit score impact

- Requires significant upfront funds

- Tax implications on forgiven debt

- Creditors may not agree to settle

- Accounts must be delinquent (hurts credit)

- May face collection efforts during negotiation

Can You Do Both?

In some cases, you might use both strategies:

- Settle Some, Consolidate Others: Settle high-balance, high-interest debts, and consolidate remaining manageable debts

- Settle First, Consolidate Later: Settle debts to reduce total burden, then consolidate remaining debts for easier management

- Selective Approach: Evaluate each debt individually and choose the best strategy for each

Making the Decision: Key Questions

Ask yourself these questions to determine the best option:

- Can I afford monthly payments? If yes, consolidation may work. If no, consider settlement.

- Do I have funds for a lump sum? Settlement requires 40-60% of debt upfront.

- How important is my credit score? Consolidation preserves credit better than settlement.

- How quickly do I need resolution? Settlement is faster (months) vs consolidation (years).

- What's my total debt vs income? High debt-to-income ratio favors settlement.

- Are my accounts already delinquent? If yes, settlement may be more appropriate.

- Do I qualify for a consolidation loan? Good credit is needed for favorable consolidation terms.

Cost Comparison Example

Let's say you have ₹5,00,000 in debt:

Loan Consolidation Scenario

- Total debt: ₹5,00,000

- Consolidation loan: ₹5,00,000 at 12% interest

- Monthly payment: ₹8,000 (5-year term)

- Total paid: ₹4,80,000 (over 5 years)

- Credit impact: Minimal, may improve

Debt Settlement Scenario

- Total debt: ₹5,00,000

- Settlement amount: ₹2,50,000 (50% settlement)

- Payment: ₹2,50,000 lump sum

- Total paid: ₹2,50,000 (immediate)

- Savings: ₹2,50,000

- Credit impact: Negative (50-100 points)

Professional Help

Both consolidation and settlement can benefit from professional assistance:

- Consolidation: Financial advisors can help find the best consolidation loan options

- Settlement: Settlement professionals have experience negotiating with creditors and can achieve better rates

- Both: Professionals can help you evaluate which option is best for your specific situation

Conclusion

The choice between loan consolidation and debt settlement depends entirely on your financial situation, goals, and capabilities. Consolidation is better if you can afford payments and want to preserve credit. Settlement is better if you're overwhelmed by debt and can gather funds for a lump sum payment.

Remember, there's no one-size-fits-all solution. Evaluate your situation carefully, consider your long-term financial goals, and don't hesitate to seek professional advice. Both options can lead to financial freedom—the key is choosing the one that aligns with your circumstances and objectives.