Unlock Financial

Freedom With Stress

Free Loan Settlement

A dedicated service that simplifies the often-complicated debt negotiation process, allowing you to settle your outstanding loans without the usual stress, paperwork, and uncertainty.

Why we are best for you

Our Services are designed to navigate the complexities of debt negotiation for you, ensuring a smooth, confidential, and stress-free path to settling your outstanding loans.

Personal Loan Settlement

Creditors are often most willing to accept a smaller percentage of the debt in their initial offer. They prioritize a swift recovery over the uncertainties of a drawn-out collection process.

Stop Accumulation

Early settlement stops growing interest and late fees, preventing your total debt from inflating beyond the original principal.

Quick Resolution

Securing a fast settlement reduces anxiety from collection calls and financial uncertainty, bringing an end to the obligation sooner.

Credit Impact Mitigation

While settlement has an impact, resolving the debt promptly is generally more favorable for long-term credit health than prolonged delinquency.

How we can help you

We offer comprehensive loan settlement services, handling every step from initial financial analysis and document preparation to expert negotiation with your creditors, all to secure a fair, reduced payoff amount on your behalf.

Personal Loan Settlement

Struggling with personal loan payments? We negotiate with lenders to reduce your total outstanding amount, making repayment easier and stress-free.

Legal Support & Anti-Harassment Assistance

Tired of creditor harassment? We provide legal guidance to protect you from unethical recovery practices and ensure your rights are upheld.

Loan Consolidation

Simplify your financial obligations by merging multiple debts into one manageable payment plan, reducing stress and improving financial management.

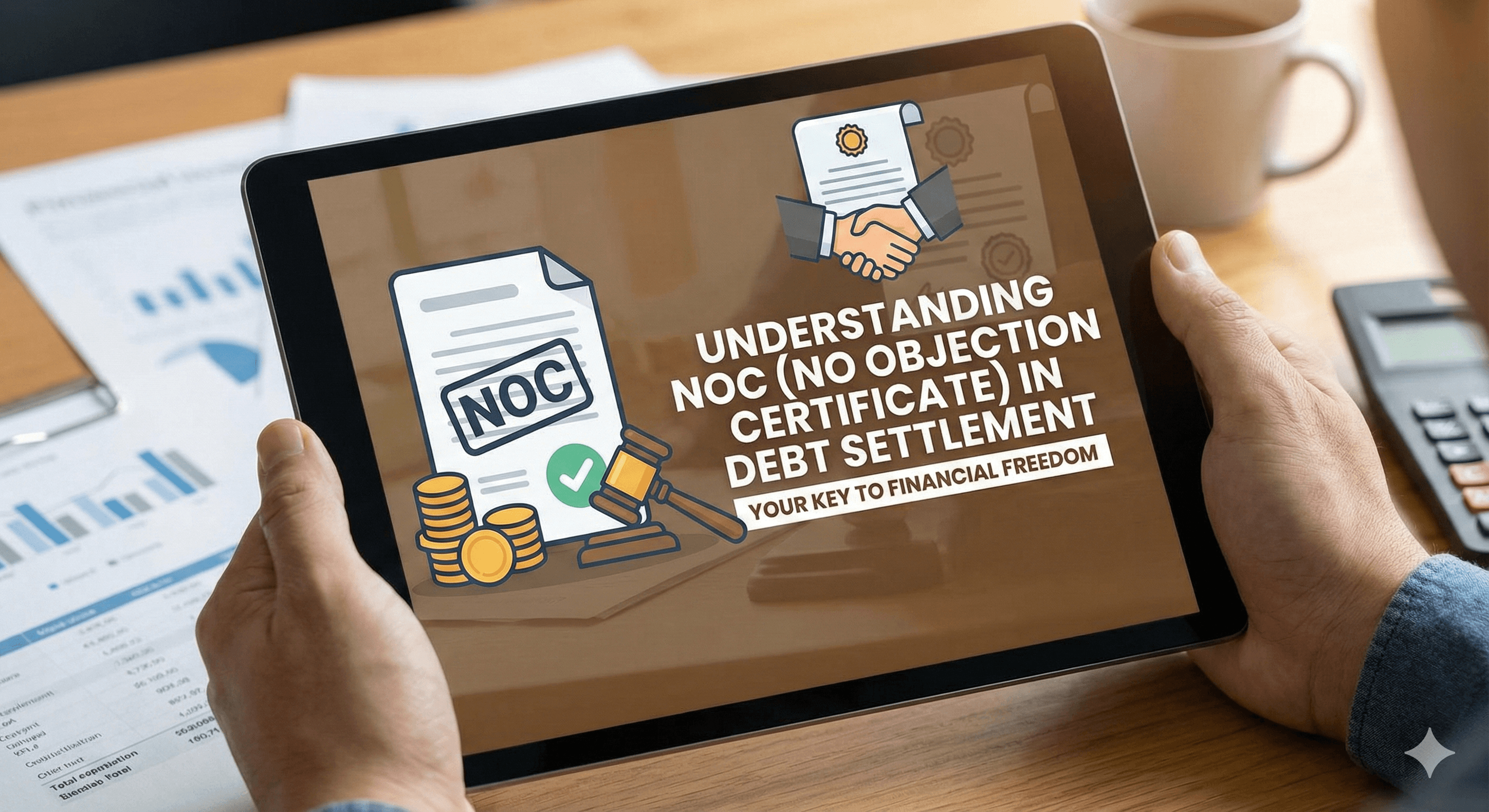

Debt Closure & Settlement Completion

Achieve financial freedom with a structured plan to clear your debts and obtain a No Objection Certificate (NOC) from your lender.

What they Say About Us

If you still have any doubts regarding us you can find how our clients had their experience with us

Google rating score: 4.9 of 5

Download your

Credit report from

Experian

"The first step to financial planning starts right here. Always check your credit score!"

FAQs

We simplify your journey to financial freedom by expertly negotiating with creditors to significantly reduce your debt. Our process handles everything from assessment to final closure, ensuring a clear path to settlement and peace of mind.

Achieve financial freedom with a structured plan to clear your debts and obtain a No Objection Certificate (NOC) from your lender.

Find more about us from case study

If you still have any doubts regarding us you can find how our clients had their experience with us

Anti-Harassment Protection: How It Solves Your Debt Problems

Learn how anti-harassment services protect you from unethical debt collection practices and provide peace of mind during your debt settlement journey.

Credit Card Debt Settlement: A Complete Guide

Learn everything about credit card debt settlement, including how it works, benefits, process, and tips for successful negotiation with credit card companies.

Understanding NOC (No Objection Certificate) in Debt Settlement

Learn what a No Objection Certificate (NOC) is, why it's crucial for debt settlement, how to obtain it, and what to do if creditors refuse to issue one.